First Step In Trading: Finding A Full-Featured Trading Platform

Entering the world of trading can be a daunting experience for beginners. The cornerstone of a successful trading journey is selecting the right online trading platform. This choice is not just about picking a tool. You need to find a partner in the technology you use. A full-featured platform isn’t just a convenience—it’s a game-changer, offering a blend of technology and resources that can significantly elevate the trading experience.

What to Look For:

Ease of Use

For newcomers, the complexity of trading can be overwhelming. That’s where the importance of a user-friendly interface comes into play. A platform that boasts a clean layout and straightforward navigation reduces the learning curve and allows traders to focus more on strategy rather than figuring out the platform itself. This ease of use is critical in making trading accessible to a wider audience.

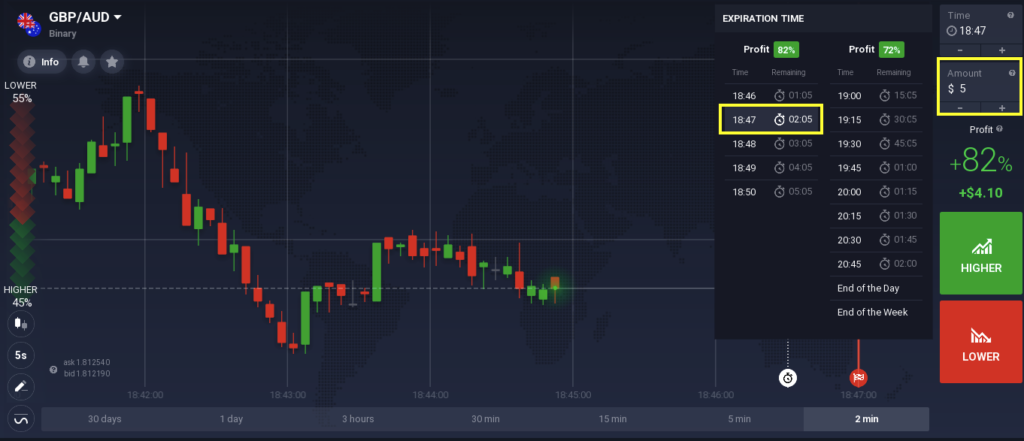

Analysis Tools

An array of analysis tools is a must for any full-featured trading platform. Real-time charts, a variety of indicators, and up-to-the-minute news feeds are essential for making informed trading decisions. These tools provide valuable insights into market trends and help traders strategize effectively.

Customer Support

Effective customer support can make a significant difference in the trading experience. Reliable support channels such as live chat, phone support, and ticket systems ensure that traders can get assistance when they need it. Quick resolution of issues and queries is crucial, especially in a fast-paced environment like trading.

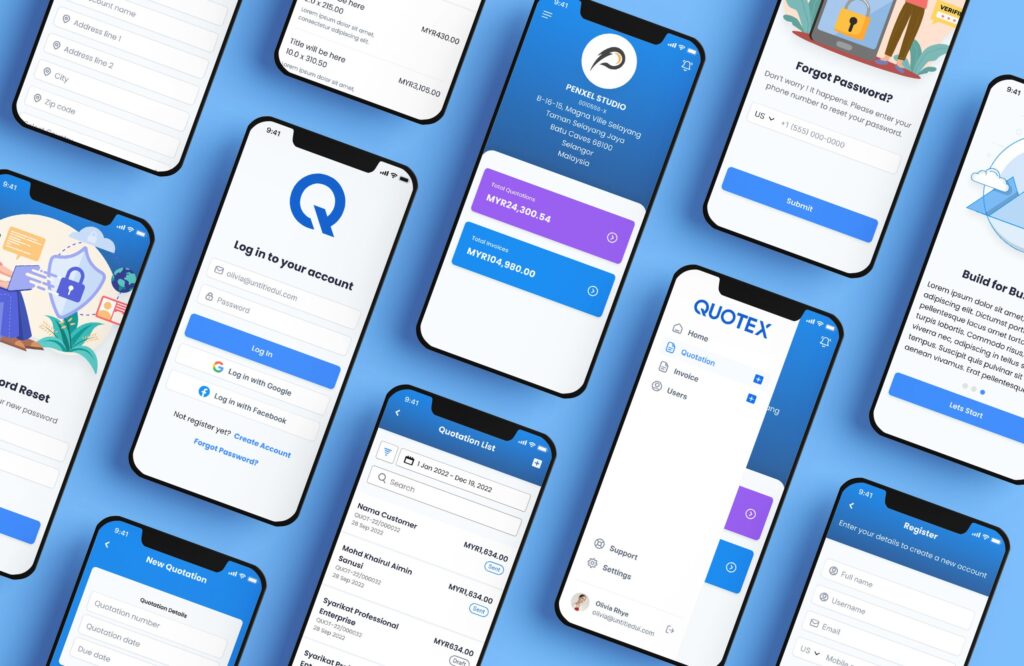

Mobile Accessibility

The ability to trade on-the-go is a necessity. A mobile version of the online trading platform should not only offer accessibility but also maintain the full range of features available on the desktop version. This mobility allows traders to stay connected and responsive to market changes, anytime and anywhere.

Conclusion

A full-featured online trading platform is a foundation upon which a trader’s success is built. From ease of use to security, every aspect plays a crucial role in shaping the trading experience. As a beginner, investing time in finding the right platform is not just a step—it’s a leap towards a successful trading career.